How Can I Increase My Returns Using Consensus Picks Reports?

Recent Case Studies Of How Consensus Picks’ Predicted Movements In Leading Stocks In Recent Quarters

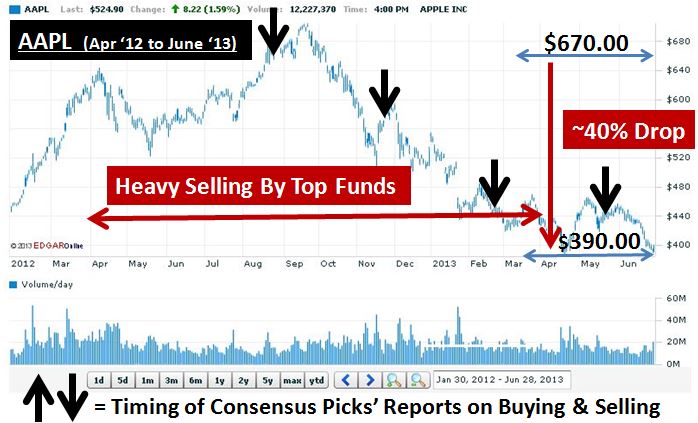

Apple Inc. (AAPL): Mega funds sold 5 mill. shares in Q2/2012, followed by four quarters of selling by our top 300 funds, during which their combined holdings fell from 381 mill. to 324 mill. shares. Guru, Mega, Tech-focused, Billionaires & New Masters fund managers all sold during this period. With slowing growth & failing technicals, an investor that sold AAPL in the $670 range based on the Q3/2012 Consensus Picks’ reports would have done so before it fell ~40% to its lows below $400.

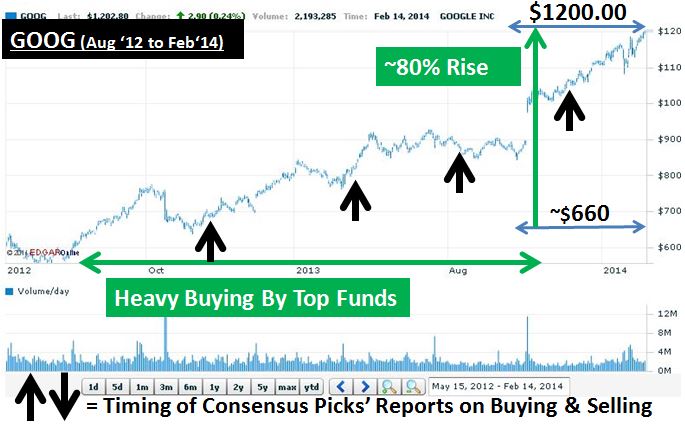

Google Inc. (GOOG): Our top 300 fund managers have been accumulating GOOG every quarter since Q3/2012, with their combined holdings rising from 125 mill. to 139 mill. shares. An investor that bought GOOG in late Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up more ~80% by Feb. 2014.

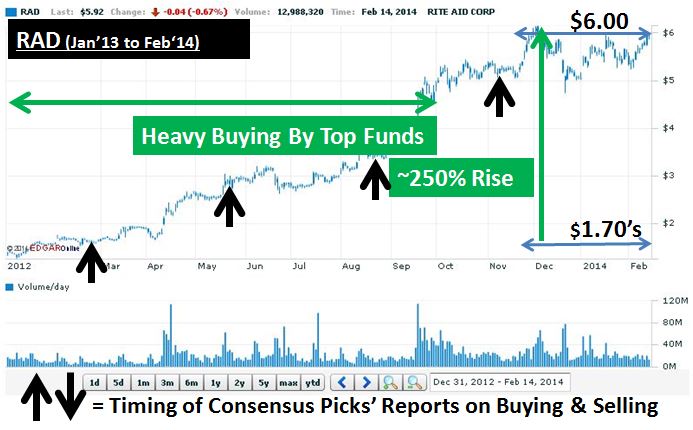

RiteAid Corp. (RAD): Our top 300 fund managers accumulated shares of drug store retail chain RAD every quarter since Q4/2012, with their combined holdings rising from 167 mill. to 291 mill. shares. Guru, Mega, Consumer-focused, Billionaire, New Masters & Tiger fund managers all bought during this period. With improving fundamentals, an investor that bought RAD in late-Feb. based on the Q4/2012 Consensus Picks’ reports would have been up ~250% by Feb. 2014.

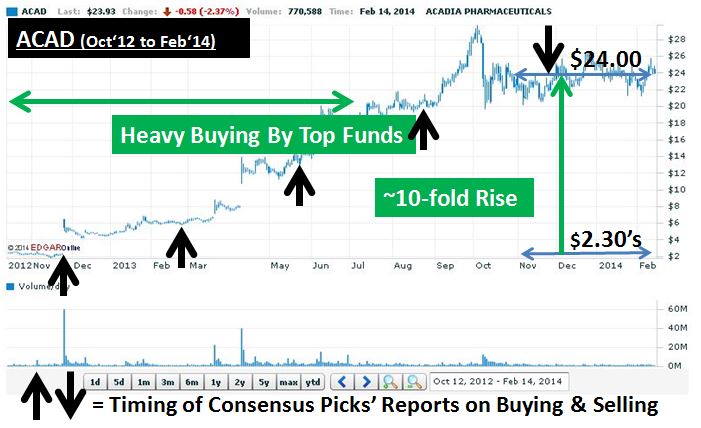

Acadia Pharmaceuticals (ACAD): Our top 300 fund managers accumulated shares of biotech ACAD for each of four quarters since Q3/2012, with their combined holdings rising from 20 mill to 66 mill. shares. With promising phase 3 data reported for its Pimavanserin drug in Parkinson’s disease, an investor that bought ACAD in late-Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up to about ten-fold by late late-Nov. 2013, when we saw selling by our top funds for the first time in over four quarters.

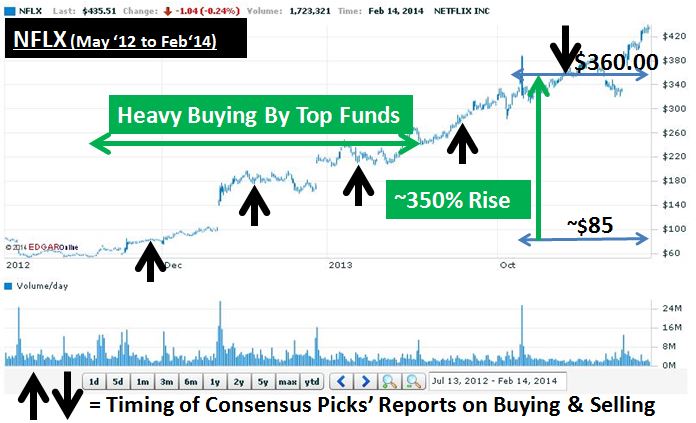

Netflix Inc. (NFLX): Our top 300 fund managers accumulated shares of NFLX, an international provider of online streaming TV & movies, in each of the four quarters since Q3/2012, with their combined holdings rising from 30 mill. to 39 mill. shares. Guru, Mega, Billionaire, New Masters and Tiger fund managers all bought during this period. An investor that bought NFLX in late Nov. 2012 based on the Q3/2012 Consensus Picks’ reports, and ahead of the recent strong increase in EPS, would have been up ~350% by late-Nov., 2013, when we saw selling by top funds for the first time in over four quarters.

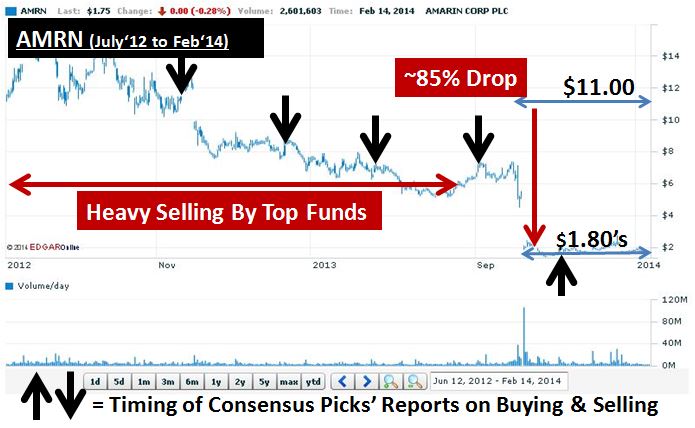

Amarin Corp. (AMRN): Our top 300 fund managers have been selling Irish pharmaceutical co. AMRN for each of four quarters since Q3/2012, with their combined holdings falling from 58 mill. to 41 mill. shares. Guru, Mega, Healthcare Sector-focused, and Billionaire fund managers all sold AMRN during this period. An investor that sold AMRN in late-Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have sold it in the $11 range vs. their price of below $2 in late-Nov., 2013, when we saw top funds buy AMRN for the first time in over four quarters.

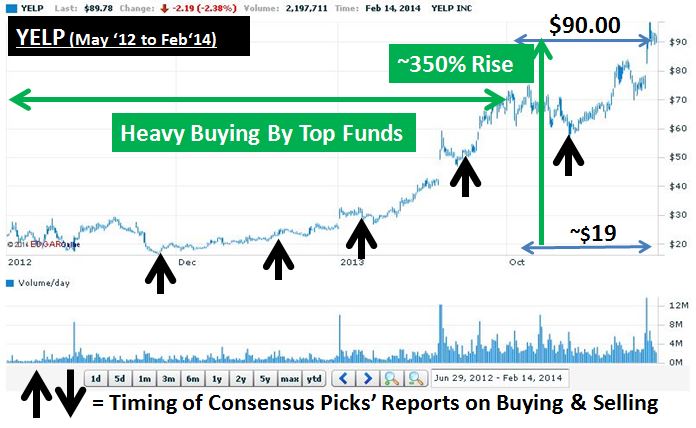

Yelp Inc. (YELP): Our top 300 fund managers accumulated shares of YELP, an online platform provider for community reviews, in every quarter since Q3/2012, with their combined holdings rising from 7 mill. to 28 mill. shares. Guru, Mega, Consumer and Technology Sector-focused, Billionaire, New Masters and Tiger fund managers all bought during this period. An investor that bought YELP in late-Nov. 2012 based on Q3/2012 Consensus Picks’ reports would have been up ~350% by Feb. 2014.

Wendy’s Co. (WEN): Our top 300 fund managers accumulated shares of WEN, a fast-food restaurant chain operator, in each of four quarters since Q3/2012, with their combined holdings rising from 188 mill. to 232 mill. shares. Guru and Mega fund managers bought during this period. An investor that bought WEN in late Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up almost 100% by late-Nov. 2013, when we saw selling by our top funds for the first time in over four quarters.

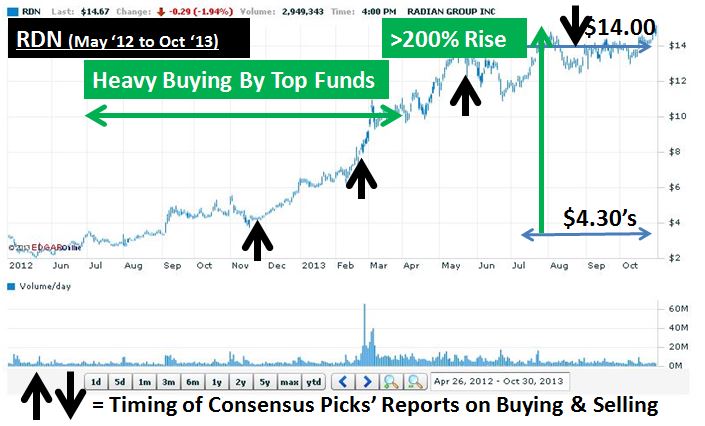

Radian Group Inc. (RDN): Our top 300 fund managers accumulated shares of RDN, a provider of mortgage and financial guarantee insurance, for each of three quarters from Q3/2012 to Q1/2013, with their combined holdings rising from 50 mill. to 97 mill. shares. Guru, Mega, Billionaire, New Masters and Tiger fund managers all bought RDN during this period. An investor that bought RDN in late-Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up over 200% by Aug. 2013, when the Q2/2013 showed net selling by our top fund managers.

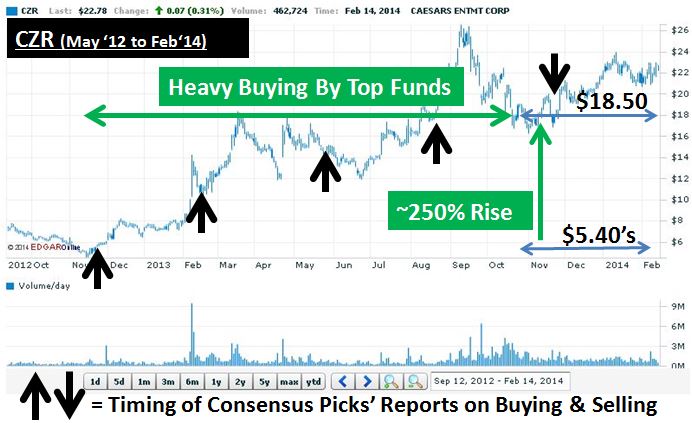

Caesars Entertainment (CZR): Our top 300 fund managers accumulated casino operator CZR for each of four quarters since Q3/2012, with their combined holdings rising from 46 mill. to 60 mill. shares. Guru, Mega and Billionaire fund managers all bought CZR during this period. An investor that bought CZR in late-Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up ~250% by late-Nov. 2013, when we selling for the first time in over four quarters.

McDermott Intl. (MDR): Our top 300 fund managers have been selling oil & gas field services co. MDR every quarter since Q4/2012, with their combined holdings falling from 113 mill. to 96 mill. shares. Guru and Mega fund managers sold MDR during this period. An investor that sold MDR in late-Feb. 2013 based on the Q4/2012 Consensus Picks’ reports would have sold it in the $13 range vs. its price of about $8 range in Feb., 2014.

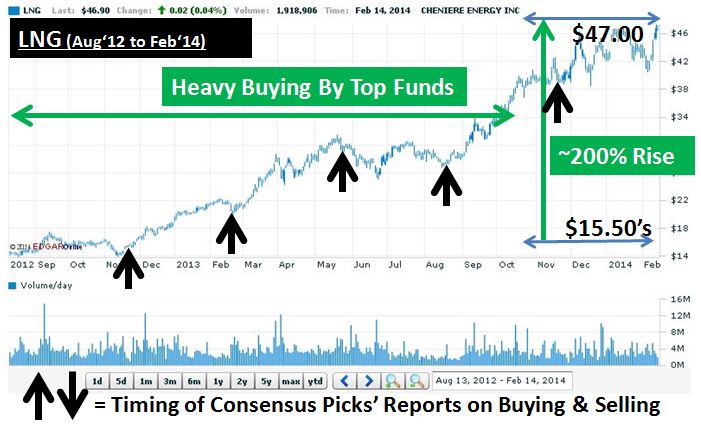

Cheniere Energy Inc. (LNG): Our top 300 fund managers accumulated liquid natural gas terminal operator LNG every quarter since Q3/2012, with their combined holdings rising from 54 mill. to 87 mill. shares. Guru, Mega, Billionaires, New Masters and Tiger fund managers all bought LNG during this period. An investor that bought LNG in late Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up ~200% by Feb. 2014.

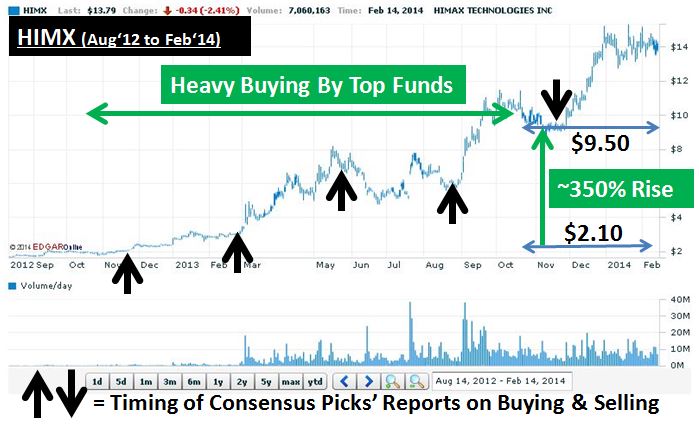

Himax Technologies (HIMX): Our top 300 fund managers accumulated Taiwanese semiconductor stock HIMX in each of four quarters since Q3/2012, with their combined holdings rising from 14 mill. to 18 mill. shares. With improving fundamentals in the semiconductor industry at the end of last year, an investor that bought HIMX in late Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up ~350% by late Nov. 2013, when our funds sold shares for the first time after four consecutive quarters of buying.

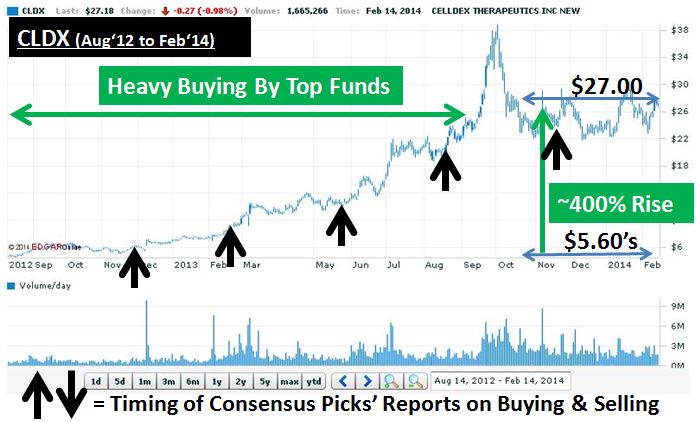

Celldex Therapeutics (CLDX): Our top 300 fund managers accumulated biotech CLDX every quarter since Q3/2012, with their combined holdings rising from 18 mill. to 44 mill. shares. Guru, Mega, Billionaire and Tiger fund managers all bought CLDX during this period. With the announcement of improved survival rates in breast cancer patients of its CDX-011 drug, an investor that bought CLDX in late-Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up ~400% by Feb. 2014.

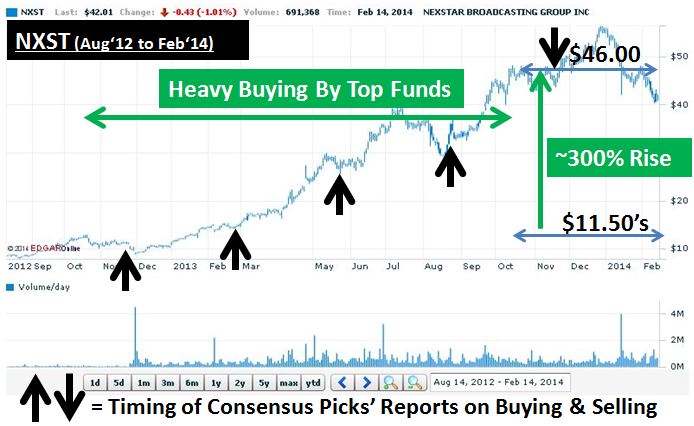

Nexstar Broadcasting (NXST): Our top 300 fund managers accumulated TV broadcasting company NXST for each of four quarters since Q3/2012, with their combined holdings rising from 5 mill. to 12 mill. shares. Guru, Mega, Consumer Sector-focused, Billionaire, New Masters and Tiger fund managers all bought NXST during this period. An investor that bought NXST in late-Nov. 2012 based on the Q3/2012 Consensus Picks’ reports, and ahead of the projected strong increase in EPS, would have been up ~300% by late-Nov. 2013., when we reported selling for the first time. As a note, shares have fallen off since then.

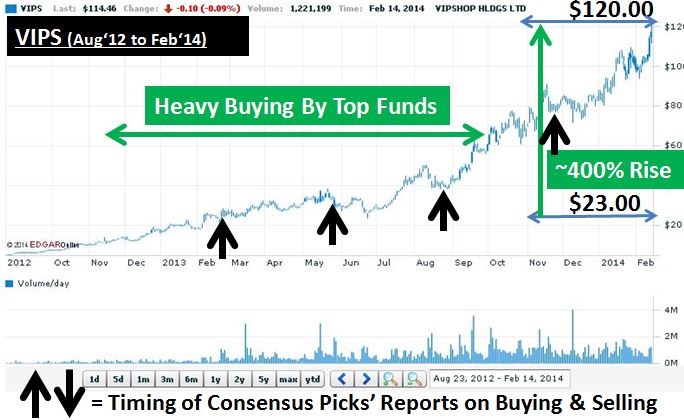

Vipshop Holdings Ltd. (VIPS): Our top 300 fund managers accumulated Chinese online discount retailer VIPS every quarter since Q4/2012, with their combined holdings rising from 0.23 mill. to 7.52 mill. shares. Guru, Mega, Billionaire, New Masters and Tiger fund managers all bought VIPS during this period. With improving fundamentals in the stock starting with the Q4/2012 earnings report, an investor that bought VIPS in late-Feb 2013 based on the Q4/2012 Consensus Picks’ reports would have been up ~400% by Feb., 2014.

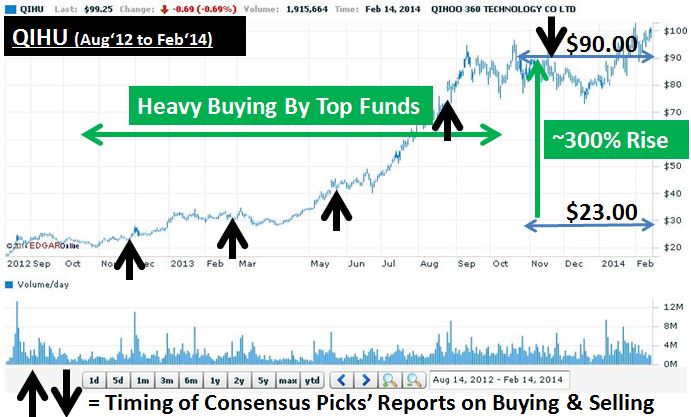

Qihoo 360 Technology (QIHU): Our top 300 fund managers accumulated QIHU, a Chinese provider of internet security, software , browsers & online games, for each of four quarters since Q3/2012, with their combined holdings rising from 19 mill. to 27 mill. shares. Mega, Technology Sector-focused, New Masters and Tiger fund managers bought QIHU during this period. An investor that bought QIHU in late Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up ~300% by late-Nov., 2013, when we showed selling by top funds for the first time in over four quarters.

Cerus Corp. (CERS): Our top 300 fund managers accumulated biotech CERS every quarter since Q4/2012, with their combined holdings rising from 22 mill. 40 mill. shares. Guru, Mega and Healthcare Sector-focused fund managers all bought CERS during this period. An investor that bought CERS in late-Feb. 2013 based on the Q4/2012 Consensus Picks’ reports would have been up ~150% by Feb. 2014.

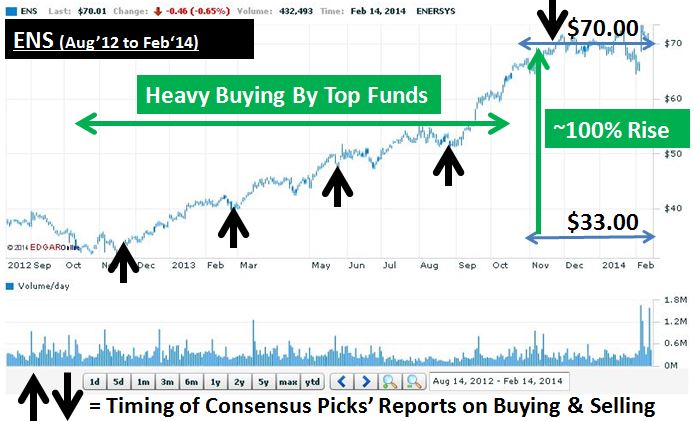

Enersys (ENS): Our top 300 fund managers accumulated industrial batteries supplier ENS for each of four quarters since Q3/2012, with their combined holdings rising from 19 mill. to 26 mill. shares. Guru and Mega fund managers bought ENS during this period. An investor that bought ENS in late-Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up ~100% by late-Nov., 2013, when we showed top funds selling for the first time in over four quarters.

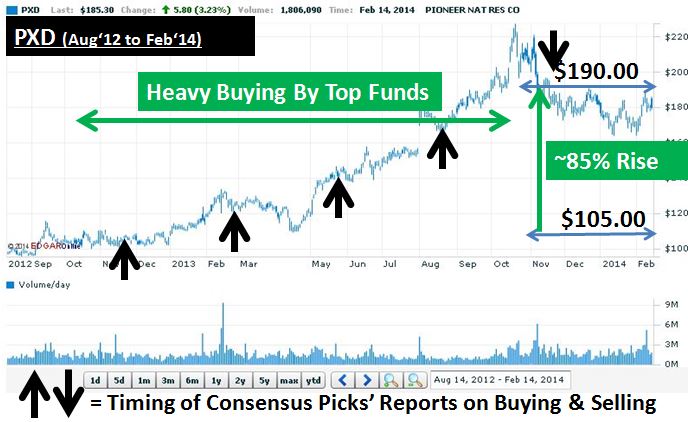

Pioneer Natural Resources (PXD): Our top 300 fund managers accumulated U.S. oil & gas exploration & production co. PXD for each of four quarters since Q3/2012, with their combined holdings rising from 73 mill. to 89 mill. shares. Guru, Mega, Energy Sector-focused, Billionaire & Tiger fund managers all bought PXD during this period. An investor that bought PXD in late-Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up ~85% by late-Nov., 2013, when we saw selling by top funds for the first time in over four quarters.

Chicago Bridge & Iron Co. (CBI): Our top 300 fund managers have been accumulating construction services provider CBI for each of four quarters since Q3/2012, with their combined holdings rising from 23 mill. to 41 mill. shares. Guru, Billionaire, New Masters & Tiger fund managers all bought CBI during this period. An investor that bought CBI in late-Nov. 2012 based on the Q3/2012 Consensus Picks’ reports would have been up ~100% by late-Nov., 2013, when we saw selling by top funds for the first time in over four quarters.

Consensus Picks’ reports, exclusively from GuruFundPicks, are like having a panel of Wall St.’s leading fund managers serving as your financial ‘mastermind’. How you use this mastermind to increase your returns will depend on your personal investment style, interests and trading horizon, and how actively you manage your portfolio (for details, on which of our offerings is best suited for you, please refer to this discussion on our faq page.

Thus, a DIY investor scouting a biotech stock that is about to report an FDA decision might want to know how top fund managers, incl. biotech-focused funds, are positioning ahead of the decision. Another DIY investor may want to find the best junior gold mining stock that top funds, including those focused only on gold stocks, are most bullish about, to position themselves ahead of the eventual turn-around in the precious metals markets. And still another DIY investor might want to find out if top fund managers are buying the turnaround story on his favorite troubled stock.

Similarly, a top-ranked energy exploration or gold mining stock may offer a clue on the likely success of their exploration efforts, and if gurus are accumulating most leaders in the space, that may tell you where experts think energy and gold prices are headed. Also, if a stock with a critical earnings report is being sold by gurus or sector-specialists, that may be a clue that the company is likely to disappoint in the upcoming quarter. Other examples of using the reports, among many, could be someone trying to find a pair trade, or even someone wanting to construct a highly diverse long-short portfolio based on the top 25, 50 or even 100 guru buys & sells.

We have observed strong correlation between the consensus buys & sells of our hand-picked 300+ leading fund managers, and stock moves over the following quarters. The predictive power implicit in this correlations has also been well-documented in the over 800 articles we have written on leading financial blogs Seeking Alpha and Motley Fool. We list below additional examples of how you could have used such insights from our Consensus Picks’™ system to profit from the moves of leading stocks in recent quarters. Although we have included only popular stocks like AAPL, due to their easy familiarity with most people, our reports include the entire universe of over 5,300 U.S. exchange-traded stocks that are owned by these top fund managers

Sincerely,

Manish Babla

CEO/Founder, GuruFundPicks.com

(MBA, MS, B.Engg.)

Click here to find out more about our Consensus Picks’ Membership – for Do-it-Yourself (DIY) Investors.

Click here to find out more about our market-beating Consensus Picks’ based market-beating Newsletter Service – for all others.

Click here to find out more about our market-beating Trade Alerts Service – for Active Traders.